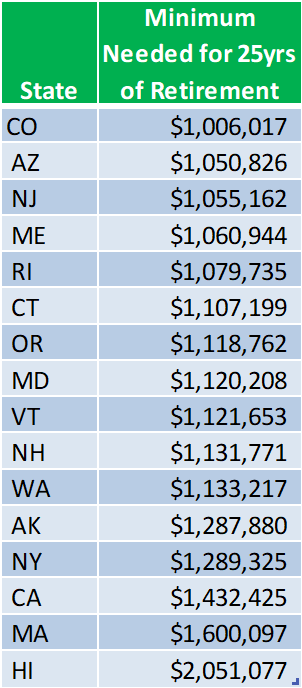

Dreaming of a comfortable retirement? The cost may surprise you. According to a recent GOBankingRates study, you'll need at least $1 million saved to retire in 16 states across the U.S.

Key Findings:

- Most Expensive States: California, Massachusetts, and Hawaii top the list, with minimum nest eggs ranging from $1.4 million to over $2 million.

- Most Affordable States: West Virginia, Mississippi, and Oklahoma offer a more budget-friendly retirement, with minimum savings needs under $700,000.

- Cost of Living Matters: Annual expenses for retirees vary significantly by state, with healthcare, groceries, and utilities being the biggest factors.

How Much Will You Need?

Retirement Calculator

Try PlanEasy's Retirement Calculator to see what you need to save in order to live your ideal retirement.

Source: https://www.gobankingrates.com/retirement/planning/states-where-youll-need-at-least-1-million-to-retire/