Taxes are always an important consideration

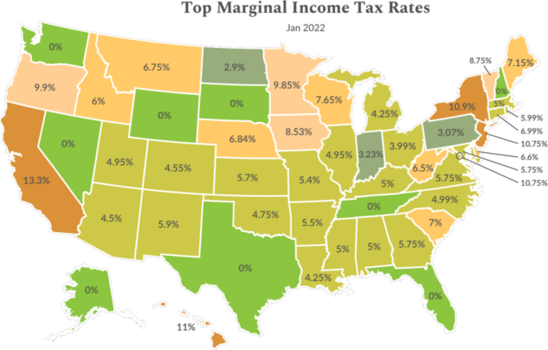

It may be worth considering retiring in another state with lower income taxes.

Taxes aren't the only factor, but they should always be considered in any retirement planning exercise.

Financial professionals can be key allies in helping you understand and address the impact of taxes on your retirement.

Tax Planning Basics

What’s the Difference Between Estate Tax and Inheritance Tax?

What's the difference between an estate tax and an inheritance tax? Not every state has either, but some do. Maryland has both.

Americans are moving

Taxes may have been a factor for many Americans who moved from their state during 2020 to 2022, including the pandemic.

2024 State Taxes

Read about changes to various state taxes in 2024. Your state could be on the list.

Tax benefits of fixed annuities

Interest gained each year for a fixed annuity is NOT taxed until you withdraw the money, similar to IRAs and 401(k) plans.

How our annuity marketplace works

2

You’ll be taken to our annuity marketplace where you can see the latest fixed annuity products along with the current interest rate for each

3

After selecting a fixed annuity that you like, you can click on “Apply Now” to begin applying for that particular annuity. You’ll then be led through our simple, elegantly designed application experience