Lock in High Interest Rates with Fixed-Rate Annuities: Your Guide to Secure Retirement Income

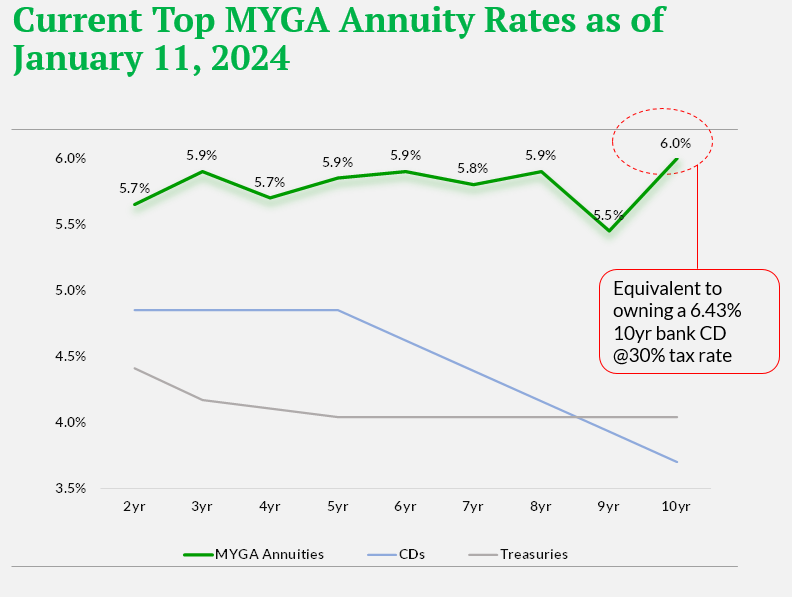

Are you searching for a safe and guaranteed way to boost your retirement income? Look no further than multi-year guarantee annuities (MYGAs), an increasingly popular option offering rates as high as 6.00% in today's market.

See below the latest MYGA rates relative to Treasuries and bank CDs. (If you'd like this chart sent to you as part of our weekly report, please email us at support@planeasy.com with the word "report". This report has many other timely market and macro data points, such as Treasury yield curve moves, inflation, GDP, etc.)

What are MYGAs?

Think of MYGAs as supercharged bank certificates of deposit (CDs). Like CDs, they guarantee a fixed interest rate for a specific term, but with a key advantage: tax-deferred growth. This means your interest compounds without taxes until you withdraw it, potentially growing your nest egg much faster.

Why are MYGAs hot right now?

Simple – unprecedented interest rates. Compared to historical lows, today's MYGA rates are a golden opportunity to secure reliable income for years to come. Plus, longer terms like 5 or 10 years lock in these juicy rates for optimal long-term growth.

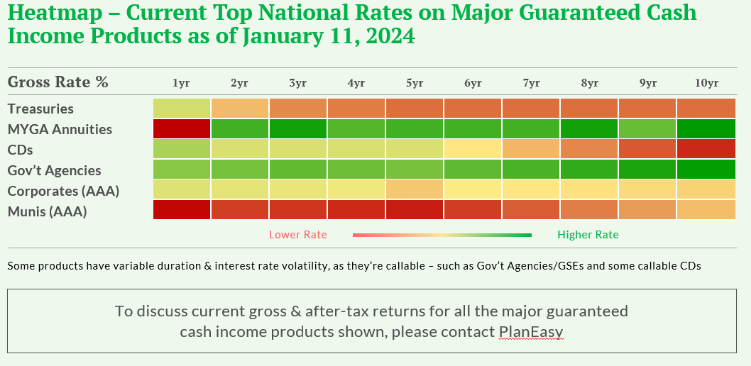

Here is a heatmap of where the highest rates are available by term. Green suggests the most value, whereas red is less value. Note that MYGAs and government agencies currently offer the most value across most terms, but government agency bonds are callable (i.e. homeowners can refinance their mortgages, effectively shortening the term of the mortgage).

(If you'd like this chart sent to you as part of our weekly report, please email us at support@planeasy.com with the word "report" in the subject. This report has many other timely market and macro data points, such as Treasury yield curve moves, inflation, GDP, etc.)

Laddering: Maximize Flexibility and Income

Have a larger sum to invest? Consider "laddering" your MYGAs. Spread your money across different term lengths (e.g., 5 and 10 years) to enjoy both consistent current income from shorter terms and future flexibility as longer terms mature. This strategy balances immediate needs with securing high rates for the future.

Peace of Mind with Liquidity and A.M. Best Ratings

While locking in long-term rates is tempting, liquidity concerns might linger. Most MYGAs offer provisions like penalty-free annual withdrawals (often up to 10%), giving you access to your funds if needed. Additionally, prioritize choosing annuities from insurers with strong A.M. Best ratings, ensuring you're partnering with financially stable institutions.

MYGAs for IRAs and Roth IRAs: Double the Advantage

MYGAs shine within IRAs and Roth IRAs too. For traditional IRAs, choose an IRA MYGA that allows penalty-free RMD withdrawals, simplifying your later years. In Roth IRAs, MYGAs' tax-free growth becomes even more powerful, creating a potent wealth-building machine.

Don't Miss This Rate Window

While interest rates remain historically high, their descent is inevitable. Locking in today's attractive MYGA rates could significantly boost your retirement income for years to come. Remember, consult a financial advisor to ensure MYGAs fit your individual retirement plan.

Ready to start securing your future?

Visit PlanEasy, the industry leader when it comes to annuities and retirement products - we know them because we have created them when we ran an annuity insurance carrier. Visit www.planeasy.com to compare rates from dozens of annuity insurers and find the perfect MYGA for your needs. For a free consult, call us at 402-235-5150 or email us at support@planeasy.com