2023 Year-End in Review

(If you're interested in regularly receiving this PlanEasy "Big Picture" Dashboard, please email us at support@planeasy.com)

S&P 500: Seems Expensive?

Most publications will let you know that the S&P 500 increased more than 24% in 2023. But where did the S&P 500 end 2023 in terms of valuations? From a big picture perspective, is it currently cheap or expensive?

We like to look at the forward earnings yield of the S&P 500 - its forward earnings yield ended 2023 at 4.9%. For the mathematically inclined, that's the inverse of the 20.4x Fwd P/E multiple that the index ended the year at. Over 20 the last years, the forward earnings yield on the S&P 500 has ranged from 4.0% to 10.6%, according to publicly available data sources.

This 4.9% forward earnings yield is in the 9th percentile over the last 20 years, suggesting it is relatively expensive compared to long-term history. In other words, an investor buying today at current valuations is not getting as much forward earnings yield as they could have relative to the past. This forward earnings yield isn't indicative of future performance of the S&P 500, but it does say a lot in terms of valuation relative to long-term history.

When looking at stock market indices like the S&P 500, we like looking at earnings yields because we can compare them to yields on Treasuries, which are also shown below. As one can see below, the 10-year Treasury at 3.88% and 30-year Treasury 4.03% are not too far behind the S&P 500's forward earnings yield of 4.9%. In other words, an investor is not getting much incremental yield from the S&P 500 relative to longer-dated Treasuries, which are considered risk-free and guaranteed by the credit of the U.S. government. One caveat is that a stock investor in the S&P 500 gets upside in the earnings growth of the companies underlying the S&P 500 index.

All stats are updated as of 12/29/23, the last trading day of the prior year:

Source: Multiple public data sources, as of 12/29/23

10-Year Treasury Yield: Decline of More than 80 bps in Two Months

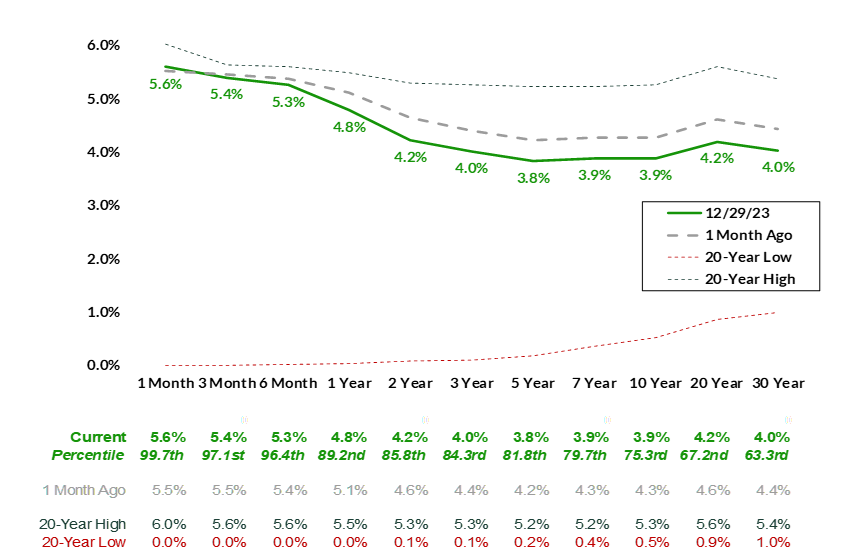

The benchmark 10-year Treasury saw its yield decline significantly by 0.81% from 4.69% at the beginning of October '23 to 3.88% at the end of 2023. This is a significant move. In the grand scheme of things, shorter-dated Treasury yields have hung on to remain close to their 20-year highs, as shown below.

However, in the past few months, we have seen the middle and the back end of the Treasury yield curve start to decline aggressively, as shown below. While 1-month Treasuries ended 2023 yielding 5.6%, hanging on to rank still in close to the 100th percentile (over the past 20 years), the 10-year at 3.88% (3.9% rounded) is now in the 75th percentile over the past 20 years.

Current Treasury Rates

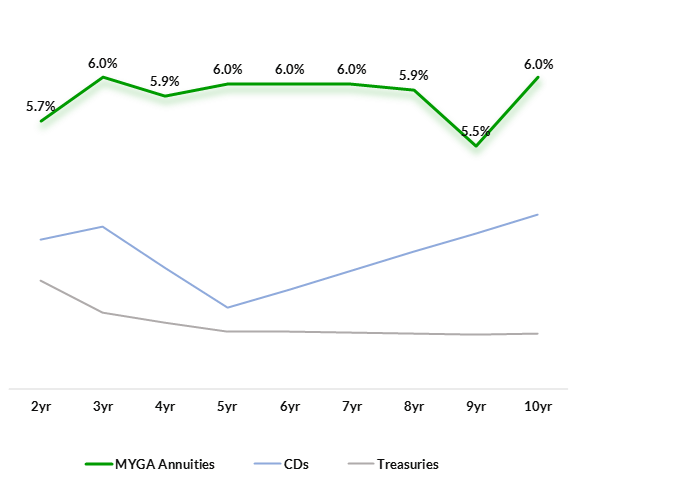

Annuities: Currently Great Value at 6% Guaranteed Rate

With current fixed annuity rates of around 6% offered by high-quality "A" rated carriers on our shelf at PlanEasy, we have been getting significant interest and inquiries from clients looking to learn more about these products to lock in current rates.

In response to the recent declines in 10- to 30-year Treasury yields discussed above, we have seen annuity carriers aggressively cut their fixed annuity rates significantly, as well. While there is a lag in these annuity rate cuts relative to Treasury moves, if these recent declines in Treasury yields hold or continue, we expect rates on annuities to continue to be cut. Many of our clients have anticipated these rates cuts and/or are attracted to the relative value offered in current annuity rates, that they have proceeded to submit annuity applications with us.

Current MYGA Annuity Rates

Please ask us if you have any questions about what we're seeing in the annuity markets or in other relevant markets. We're available at support@planeasy.com or 402-235-5150.

(If you're interested in regularly receiving this PlanEasy "Big Picture" Dashboard, please email us at support@planeasy.com)